Harnessing Artificial Intelligence for Regulatory Compliance

AI is transforming compliance by automating monitoring, improving risk detection, and ensuring regulatory adherence. While challenges like data security and regulatory shifts exist, its benefits outweigh the risks.

The Role of AI in Modern Compliance Frameworks

Regulatory compliance is a critical function in organizations across various industries, requiring adherence to evolving legal frameworks and standards. Traditionally, compliance processes relied on manual monitoring and reporting, which was often time-consuming and prone to errors. However, the advent of artificial intelligence (AI) is reshaping this landscape, enabling companies to automate complex compliance tasks and enhance their regulatory adherence.

AI systems leverage machine learning algorithms to analyze large volumes of regulatory data, identify changes in legal requirements, and suggest necessary adjustments in real-time. By integrating AI-driven tools, businesses can proactively mitigate risks, detect fraudulent activities, and ensure compliance with global and local regulations.

Integrating AI into Compliance Processes

Implementing AI into compliance workflows requires a strategic approach that aligns with an organization's operational goals. Businesses must evaluate their specific compliance challenges and determine how AI can optimize their risk management processes.

Automated regulatory monitoring allows AI-powered tools to continuously track regulatory changes and provide timely alerts, reducing the need for manual updates. Machine learning algorithms play a crucial role in risk assessment and fraud detection by analyzing patterns to predict potential compliance breaches, helping organizations take preventive measures. AI can also streamline compliance by automating reporting and documentation, ensuring transparency and reducing human effort. Additionally, natural language processing (NLP) tools enhance legal interpretation by helping organizations decode complex legal texts, making compliance requirements easier to understand and implement.

By integrating AI into compliance programs, businesses can not only streamline their operations but also improve overall regulatory efficiency and risk management.

How AI is Transforming Compliance Programs

The introduction of AI-driven compliance solutions is leading to a paradigm shift in regulatory management. Organizations are increasingly leveraging AI technologies to strengthen their compliance frameworks and enhance decision-making capabilities.

AI enables real-time monitoring and analysis of financial transactions, allowing businesses to detect anomalies indicative of money laundering or fraudulent activities. It also enhances proactive risk mitigation by utilizing predictive analytics to anticipate compliance risks before they escalate, reducing financial and reputational damage. AI-driven insights significantly improve decision support, empowering compliance officers to make data-backed decisions quickly and efficiently.

These advancements are transforming compliance from a reactive process to a proactive strategy, empowering businesses to maintain regulatory integrity in an increasingly complex landscape.

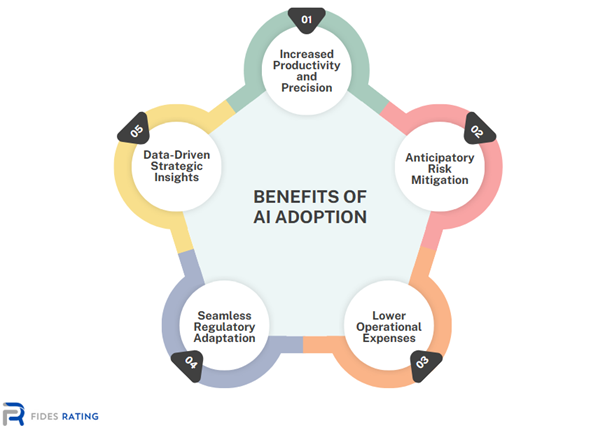

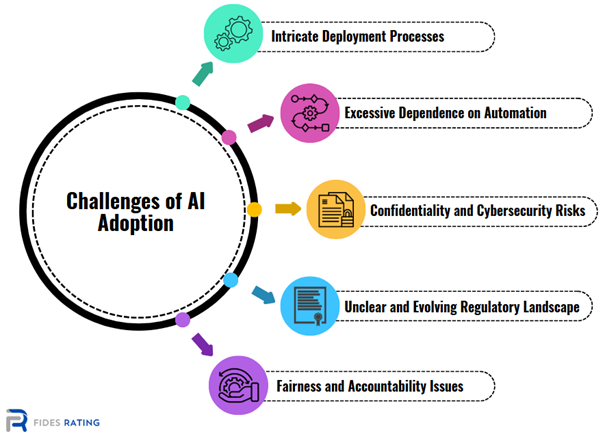

Benefits and Challenges of AI Adoption in Compliance

AI presents numerous benefits in compliance management. One major advantage is that it optimizes operational performance by automating compliance tasks and reducing human errors. Another benefit is its ability to foresee potential regulatory breaches, allowing businesses to take preventive measures before issues arise. AI also minimizes operational expenses by streamlining processes and reducing the resources required for manual compliance checks. Furthermore, it enables organizations to swiftly adapt to evolving regulatory landscapes, ensuring they remain aligned with new laws and industry requirements. Additionally, AI-driven insights facilitate more informed and data-supported decision-making, enhancing the overall strategic approach to compliance.

Despite these advantages, organizations face challenges when adopting AI for compliance. One significant hurdle is regulatory acceptance, as some regulatory bodies require proof of AI transparency and fairness before approving its use. Additionally, data privacy concerns remain a critical issue, as businesses must ensure that AI-driven compliance systems comply with data protection laws. Another challenge is the high implementation cost, as integrating AI compliance solutions often requires a substantial initial investment and a thorough cost-benefit analysis.

Organizations must carefully weigh these benefits and challenges to successfully integrate AI into their compliance strategies.

The Future of AI in Compliance Management

The evolution of AI in compliance is set to accelerate, with emerging technologies paving the way for more sophisticated regulatory tools. Future trends may include AI-powered predictive compliance, where advanced analytics forecast potential compliance risks before they occur, allowing companies to take preventive action. AI-driven personalization is also expected to grow, enabling compliance programs to be tailored to specific industries, regulatory jurisdictions, and organizational needs. Additionally, the integration of AI with blockchain technology could enhance transparency and immutability in regulatory reporting.

As AI continues to evolve, its role in compliance management will expand, enabling businesses to stay ahead of regulatory challenges and foster a culture of ethical governance.

In conclusion, AI is revolutionizing the compliance landscape by offering powerful tools for regulatory monitoring, risk management, and fraud detection. While challenges remain, the benefits far outweigh the risks, making AI a vital asset for organizations striving to maintain compliance in an increasingly regulated world.